FINOS Joins the Linux Foundation

The Linux Foundation | 09 April 2020

Introduction

This week we are excited to announce that FINOS, the Fintech Open Source Foundation, is joining our Linux Foundation community of projects. With critical financial services projects under its stewardship, FINOS has become the hub for open collaboration in the financial services industry. FINOS serves similar needs to other vertical industry communities at the Linux Foundation, such as the Academy Software Foundation focused on the motion picture industry, Automotive Grade Linux focused on the automotive industry, and others. With FINOS at the LF, we are excited for the many cross community collaboration opportunities.

What is FINOS and What Challenges is it Helping Financial Services Firms Address?

FINOS’ purpose is to accelerate collaboration and innovation in financial services technology through the adoption of open source software, standards and best practices.

FINOS is composed of over 30 member organizations, developing software and standards for data and data technologies, cloud services, financial desktop applications, and more. It is unique among open source foundations in that it is an open community for financial services and fintech firms to address unique industry challenges, as opposed to being horizontal across industries.

Financial services firms face unique obstacles to open source collaboration, including legal & regulatory concerns, internal policies, cultural friction, and heavily restricted technology environments. FINOS is a path to working outside corporate boundaries with others in the industry that are trying to solve the same problems.

In order to more efficiently leverage open source, FINOS supports its members every step of the way starting with its Open Source Readiness Project, providing guidance and tools for financial services participants new to open source.

In addition to providing reference guides and policy templates that financial organizations may use in adopting open source software, FINOS provides tools that include frameworks and underlying shared code for creating the foundational backbone & infrastructure, middleware, data and application layers for open source financial applications.

To assist in the consumption of these tools, FINOS also runs regular readiness meetings to help financial services organizations discuss common challenges, share successful experiences and more broadly prepare for the adoption of open source software.

Why Does the Financial Services Industry Need Open Source Software and Organizations Such as FINOS?

As with other vertical industries, the financial services industry can realize the same benefits by adopting open source technologies. This is achieved by reducing overall total cost of ownership by sharing the development of common software components and underlying technology infrastructure through mutualization — this allows financial services and fintech firms to quicken their time to market for their services and product offerings and improve overall software quality.

Having a broader pool of developers working on open source financial software enables financial services companies to attract and retain talent from a larger pool. Embracing open source software also allows IT stakeholders and decision-makers in financial services organizations to de-risk software investments by reducing vendor lock-in, and fostering internal and external re-use of software components.

Additionally, open software and open standards can dramatically simplify workflow integration and improve interoperability between financial institutions, counterparties, and even regulators. This increases firms’ ability to meet rapidly changing client and regulatory needs more quickly and seamlessly.. Ultimately, FINOS seeks to create a “build once” approach to many aspects of financial technology solutions and leverages its community experts and active board-level engagement from a wide range of prominent leaders within finance.

Finally, it enables financial and technology firms working in this space to learn about high-value and industry-wide business challenges that can inform and validate product and project roadmaps.

FINOS Project Highlights

The value of FINOS is expressed through its many programs and services, which include, but are not exclusive to these open source software and open standardization projects:

The FINOS open source software project landscape. Image Credit: FINOS

FDC3: Launched in 2017 by OpenFin in collaboration with major industry participants, FDC3’s mission is to develop specific protocols and taxonomies to advance the ability of desktop applications in financial workflows to operate in a plug and play fashion, without prior bilateral agreements. Under the neutral FINOS umbrella, and now the Linux Foundation, FDC3 is now widely adopted and has received contributions from several banks, buy-side firms, consultancies, and financial technology vendors.

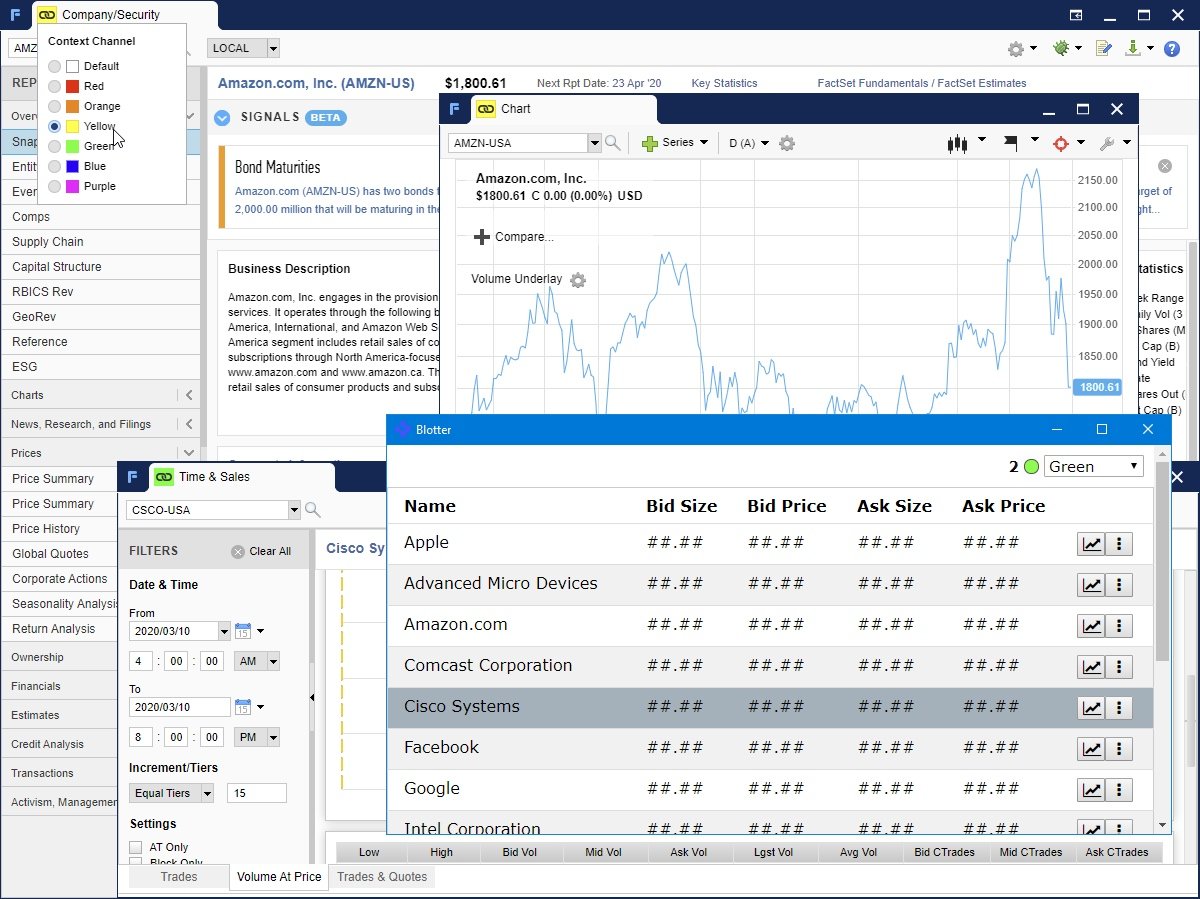

A sample FDC3 application. Image Credit: FINOS

Plexus: Contributed to FINOS in 2017 by Deutsche Bank and developed in the open as part of its production Autobahn platform, Plexus defines an open standard for desktop application interoperability with a container-agnostic reference implementation. This enables seamless workflows between independent apps developed by different organizations in different technologies. The project aims to be a fully documented open standard and open source platform designed to connect thousands of different applications from across the financial services industry, enabling banks’ and clients’ systems to talk to each other.

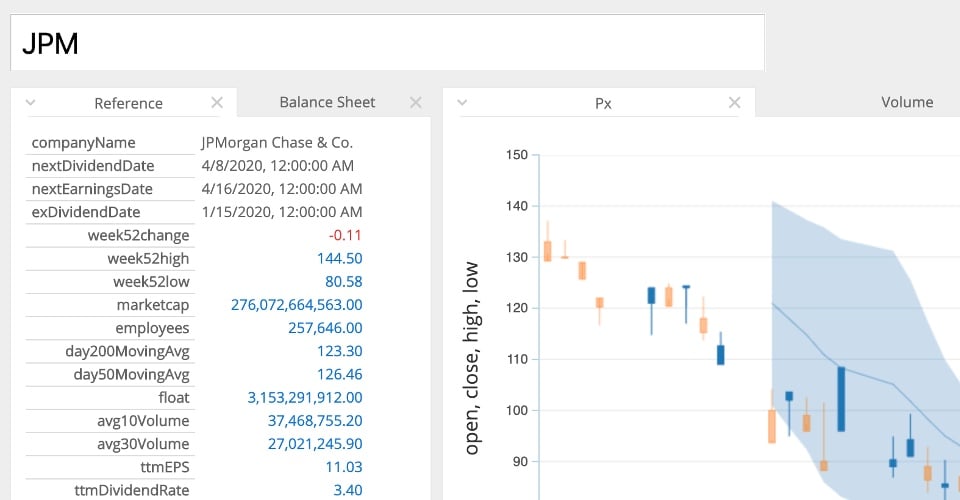

Perspective: Initially developed by JP Morgan’s trading business, Perspective is an interactive Web Assembly based data streaming and visualization component for large, real-time datasets. It comes with a suite of simple context-aware visual plugins for D3FC and Hypergrid, an integration with Jupyterlab, and runtime modules for the browser, Python, and Node.js. Perspective is a mature, production-ready library with a highly engaged community that is now increasingly used in production environments and is contributed to by FINOS institutional member organizations.

A sample Perspective application. Image Credit: FINOS

Alloy: Set to be contributed to FINOS by Goldman Sachs later in 2020, the Alloy workbench and the underpinning Pure language offer an advanced modeling environment to explore, define, connect and integrate data into financial business processes. Although it can help firms address internal challenges the greater benefit comes from the huge potential for the industry to share, collaborate and standardize on common data models for trading, instrumentation, regulatory reporting and more. A pilot is currently ongoing among major banks and documentation is available at alloy.finos.org.

Cloud Service Certification: Originally contributed to FINOS by JP Morgan who was working internally on building infrastructure as code controls to meet its own cloud deployment regulatory requirements, the Cloud Service Certification was created with the rationale that most banks were undergoing similar efforts — thus the benefits of mutualization could be extended to not only technology implementation, but also on regulatory interpretation, as well. The overall goal of the project is to build commonly interpreted BDD-style tests to verify regulatory compliance of cloud services for Cloud Service Providers (CSP) in order to build test implementations that can be used to prove the regulatory worthiness of cloud services on an ongoing basis. Several firms involved in the Cloud Service Certification include JP Morgan, Deutsche Bank, UBS, Red Hat, Wipro and ScottLogic, and FINOS is actively recruiting new banks and vendors to participate.

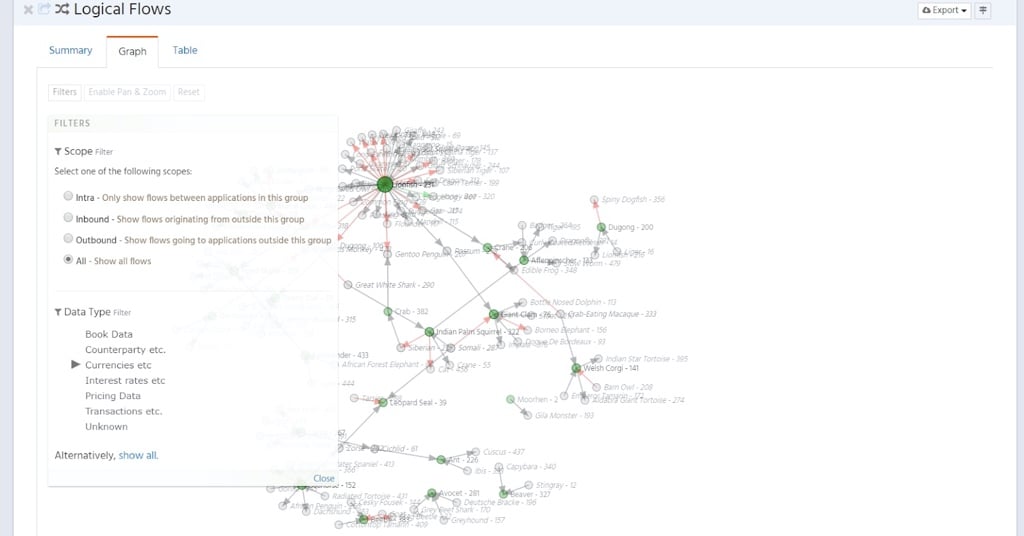

Waltz: Developed by Khartec Ltd and FINOS Platinum Member, Deutsche Bank, Waltz was created to help large organizations understand their application environment in a consistent, well-documented, easily digestible format, and to address complex enterprise architecture data organizational issues often encountered in their overall technology landscape. Waltz shows where applications reside, what they do, and how they are connected. Waltz has been used to assist with key performance metrics, data lineage, regulatory responses, and application rationalization/migration programs.

A sample Waltz data model for a large enterprise environment. Image Credit: FINOS

Why is FINOS Joining the Linux Foundation?

FINOS has grown significantly in the last two years, bringing greater awareness of open source to the financial services industry and in turn increasing the level of collaboration amongst industry participants. Joining the Linux Foundation will help FINOS accelerate this engagement even more. With common core values and highly compatible systems of governance FINOS will be able to take advantage of increased scalability and mutualization that only being part of a much larger foundation can provide, particularly through the Linux Foundation’s extensive support program offerings including but not limited to training, certification and events management.

As with the Linux Foundation which acts as a neutral party for open source projects of all types, FINOS provides a neutral space for fintech firms to build open solutions with its projects and platforms in a neutral forum. At the Linux Foundation, FINOS will be able to continue sponsoring projects with strong disruption potential in a traditionally locked-in and proprietary industry, and will continue to permit frictionless engagement between financial services developers who are actively contributing to FINOS in full compliance.

FINOS currently uses a governance by contribution model which enables them to be operated transparently and independently under the oversight and steering of its board of directors. This is in direct alignment with the Linux Foundation’s “do-ocracy” model where responsibilities are attached to people who do the work rather than elected or selected by some identified decision-maker. Likewise, the Linux Foundation’s projects also operate transparently and independently, and each community develops its own operational guidelines that serve to create a working technical collaboration.

As with the Linux Foundation, FINOS has projects that are organized into thematic programs which provide easy discoverability, and federated governance over its community.

FINOS already hosts over a hundred collaborative projects that are contributed to by its members, external companies and individuals.

As its communities continue to scale, FINOS will need additional support staff and the abilities of an experienced, larger umbrella organization to help it achieve its goals. The toolsets and procedures, fundraising support, and overall entity management which FINOS will inherit as a result of joining the umbrella of the Linux Foundation will help them continue to scale their programmatic efforts for many years to come.

“In less than two years FINOS has become the go-to foundation for open source collaboration in financial services. With this sector’s focus on technology-driven solutions, we feel the time is right to bring our two communities together to enable the next stage of innovation for our projects,” said Jim Zemlin, executive director at the Linux Foundation. “We look forward to working with Gab, the FINOS team and its members as we together chart the future of global financial services collaboration.”

“FINOS has achieved tremendous growth across our project portfolio thanks to our 35 members and wider community,” explained Gabriele Columbro. “The FINOS community’s passion and dedication to applying open source practices to address concrete, pressing topics — in areas such as cloud computing, financial modeling, desktop interoperability, messaging, tooling, and data technology — has established the transformative potential of open source within financial services. We are thrilled to join forces with the Linux Foundation to accelerate this growth and welcome an even more diverse set of members and projects under the FINOS umbrella.”